Are you looking to invest in cryptocurrency but wary of scams? The world of digital assets presents exciting opportunities, but it also attracts fraudulent activities. This article, “How to Avoid Common Crypto Exchange Scams,” will equip you with the knowledge to navigate the cryptocurrency market safely and protect yourself from common exchange scams, including rug pulls, pump and dumps, and phishing attacks. Learn how to identify red flags, choose reputable exchanges, and safeguard your digital assets. Protect your investments and your financial future by mastering the art of secure crypto trading.

Recognizing Fake Exchanges

Fake cryptocurrency exchanges are designed to mimic legitimate platforms, often employing sophisticated techniques to deceive users. Identifying these fraudulent operations requires vigilance and a critical eye.

One key indicator is a lack of transparent registration and licensing information. Legitimate exchanges typically display clear details about their regulatory compliance and registration with relevant authorities. Absence of this information should raise immediate suspicion.

Unrealistic promises of high returns or unusually low fees are major red flags. Be wary of exchanges advertising guarantees of substantial profits or exceptionally competitive fees that seem too good to be true. Such offers often mask malicious intent.

Examine the exchange’s website design and functionality. Poorly designed websites with grammatical errors, broken links, or unprofessional layouts are common characteristics of fake exchanges. Also, look for inconsistencies in the platform’s user interface and functionality.

Finally, conduct thorough research using independent sources. Verify the exchange’s reputation by checking reviews and ratings on reputable online platforms. Look for warnings or reports of scams associated with the exchange.

How to Verify an Exchange’s Legitimacy

Verifying a crypto exchange’s legitimacy is crucial to protecting your assets. Start by checking for a legitimate business registration. Look for evidence of registration with relevant financial authorities in their operating jurisdiction. A registered business is more likely to be accountable and less susceptible to disappearing with user funds.

Next, investigate the exchange’s security measures. A reputable exchange will clearly outline its security protocols, including measures to protect against hacking and data breaches. Look for information on things like two-factor authentication (2FA), cold storage for user funds, and regular security audits. The lack of transparent security information should be a major red flag.

Transparency is key. A legitimate exchange will openly provide information about its team, its location, and its operational structure. Look for a well-maintained website with readily accessible contact information. Be wary of exchanges with vague or hidden information about their background.

Finally, check for user reviews and ratings from reputable sources. While not foolproof, positive reviews from multiple sources can indicate a generally positive user experience. Conversely, a significant number of negative reviews highlighting scams or security issues should raise serious concerns.

By diligently checking these factors, you can significantly reduce your risk of encountering fraudulent crypto exchanges and protect your investments.

Avoiding Phishing Attacks

Phishing attacks are a major threat in the cryptocurrency world. Scammers often impersonate legitimate crypto exchanges via email, text message, or even fake websites designed to look identical to the real thing. These attacks aim to steal your login credentials, private keys, or other sensitive information.

To avoid phishing attacks, always verify the authenticity of any communication claiming to be from your exchange. Never click on links in suspicious emails or text messages. Instead, independently navigate to your exchange’s website using a bookmark or by typing the address directly into your browser’s address bar. Examine the URL carefully for any misspellings or inconsistencies.

Enable two-factor authentication (2FA) on all your exchange accounts. This adds an extra layer of security, making it significantly harder for phishers to access your account even if they obtain your password. Be wary of unsolicited phone calls or messages asking for your login details or one-time passwords (OTPs). Legitimate exchanges will never request this information proactively.

Regularly review your exchange account activity for any suspicious transactions. Report any unusual activity to your exchange immediately. Educate yourself on the common tactics used in phishing attacks, including spoofed emails, shortened URLs, and urgent requests for action.

By staying vigilant and following these best practices, you can significantly reduce your risk of falling victim to phishing attacks and protect your cryptocurrency investments.

Why You Should Never Leave Crypto on an Exchange

Leaving your cryptocurrency on an exchange exposes you to significant risks. Security breaches are a major concern; exchanges are frequent targets for hackers, and if they’re compromised, your funds could be stolen.

Furthermore, exchanges are not insured against theft or loss in the same way that banks are. If the exchange goes bankrupt or experiences a security failure, you may lose your crypto without recourse.

Finally, you lack control over your private keys when your crypto resides on an exchange. This means you are entirely reliant on the exchange’s security protocols and are vulnerable to their operational decisions. Taking possession of your private keys through self-custody is essential for true security.

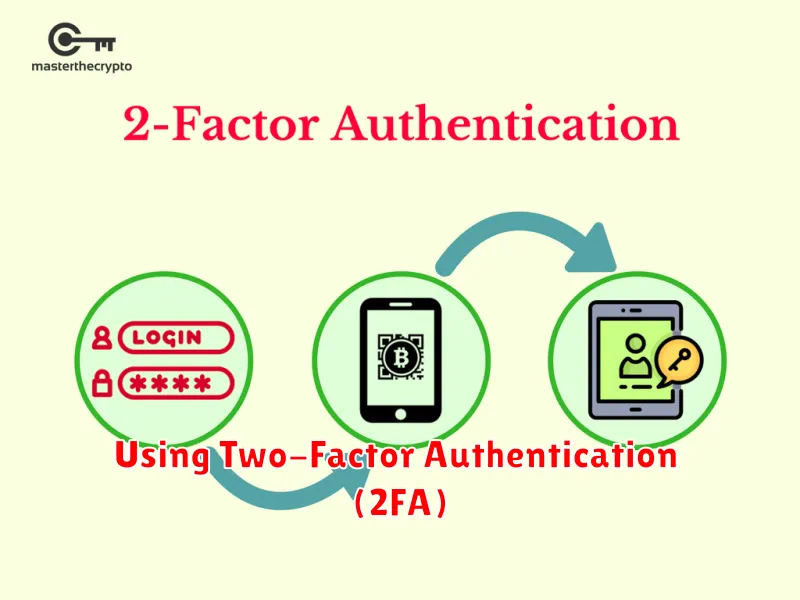

Using Two-Factor Authentication (2FA)

Two-Factor Authentication (2FA) adds an extra layer of security to your crypto exchange account. It requires not only your password but also a second form of verification, such as a code generated by an authenticator app (like Google Authenticator or Authy) or a code sent to your registered email or phone number.

Enabling 2FA significantly reduces the risk of unauthorized access, even if your password is compromised. A hacker would need both your password and access to your secondary verification method, making account breaches far less likely. Always enable 2FA on all your crypto exchange accounts.

Choose a reliable and secure 2FA method. Authenticator apps are generally preferred over SMS-based 2FA due to vulnerabilities associated with SMS systems. Consider using a password manager to securely store your passwords and 2FA recovery codes.

Remember to back up your 2FA recovery codes securely and store them offline. These codes are essential for regaining access to your account if you lose your phone or authentication app.