In the volatile world of cryptocurrency, protecting yourself from crypto scams is paramount. This article provides crucial insights into avoiding prevalent online cryptocurrency scams, helping you navigate the digital landscape safely and confidently. Learn how to identify red flags, safeguard your digital assets, and ultimately stay safe online while engaging in the exciting but risky realm of crypto investing. We’ll cover essential strategies to secure your crypto wallet, spot phishing attempts, and understand the risks associated with various online investment schemes. Don’t fall victim – become informed and protect your financial future.

Recognizing Common Crypto Scams

Cryptocurrency’s decentralized nature makes it susceptible to various scams. Understanding common tactics is crucial for protection.

Pump and dump schemes involve artificially inflating a cryptocurrency’s price through coordinated buying, then selling off holdings at the peak, leaving late investors with losses. Giveaway scams promise free cryptocurrency in exchange for sending a small amount to “cover transaction fees,” but the funds are never returned.

Phishing attacks use fraudulent emails or websites mimicking legitimate platforms to steal login credentials and cryptocurrency holdings. Romance scams leverage emotional connections to manipulate victims into sending cryptocurrency. Investment scams often use fake celebrity endorsements or promises of unrealistic returns to lure in investors.

Fake cryptocurrency exchanges or wallets appear legitimate but steal deposited funds. Always verify the legitimacy of any platform before engaging. Rug pulls involve developers abandoning a project and absconding with investors’ funds.

High-yield investment programs (HYIPs) promise abnormally high returns with little or no risk, which is a major red flag. Be wary of any investment opportunity that seems “too good to be true.”

How to Identify Fake ICOs

Identifying fake Initial Coin Offerings (ICOs) requires careful scrutiny. Many scams operate with sophisticated techniques, but several red flags can help you avoid them.

Lack of a Whitepaper: A credible ICO will have a detailed whitepaper outlining the project’s goals, technology, team, and financial projections. Absence of a whitepaper or a poorly written one should raise immediate concerns.

Unrealistic Promises: Be wary of guarantees of high returns or promises of quick, easy riches. Legitimate projects focus on long-term value creation, not get-rich-quick schemes.

Anonymous or Unknown Team: Legitimate projects usually feature a transparent team with verifiable identities and experience. An anonymous team is a major red flag suggesting a potential scam.

Pressure Tactics: High-pressure sales tactics, limited-time offers, or aggressive marketing urging immediate investment should be considered suspect. Legitimate projects offer ample time for due diligence.

Unregistered or Unlicensed: Check if the ICO is registered with the relevant financial authorities. Operating without proper registration can indicate a lack of legitimacy.

Poor Website Quality: A poorly designed website with grammatical errors, broken links, or unprofessional design is a significant warning sign.

Unclear Token Utility: Understand the purpose and utility of the offered token. If its use case is vague or non-existent, it’s likely a scam designed to collect funds without offering anything of real value.

Due diligence is paramount. Research thoroughly, consult trusted sources, and never invest more than you can afford to lose.

Avoiding Phishing Attacks in Crypto

Phishing attacks are a major threat in the cryptocurrency world. Scammers often impersonate legitimate exchanges, projects, or individuals to steal your private keys, seed phrases, or other sensitive information.

To avoid these attacks, carefully scrutinize all communications. Never click links or download attachments from unverified sources. Always independently verify the sender’s identity by checking their official website or contacting them through known channels.

Legitimate cryptocurrency platforms will never ask for your private keys or seed phrase directly. Be wary of unsolicited emails, messages, or phone calls requesting such information. Remember, you are solely responsible for securing your cryptocurrency holdings.

Enable two-factor authentication (2FA) wherever possible. This adds an extra layer of security, making it harder for phishers to access your accounts even if they obtain your password.

Regularly review your account activity for any unusual transactions or unauthorized access attempts. Report any suspicious activity to the relevant platform immediately.

Finally, stay informed about the latest phishing techniques and scams. Educating yourself is a crucial first step in protecting your crypto assets.

Ponzi Schemes in the Crypto Industry

The cryptocurrency market’s decentralized nature and lack of stringent regulation make it fertile ground for Ponzi schemes. These fraudulent operations promise high returns with little to no risk, attracting investors with the allure of quick profits.

Unlike legitimate investments, Ponzi schemes don’t generate profits through actual business activities. Instead, they pay earlier investors with funds from newer investors. This unsustainable model inevitably collapses when the influx of new money dries up, leaving the majority of participants with significant losses.

Red flags to watch out for include: exceptionally high and guaranteed returns; pressure to invest quickly; lack of transparency regarding the investment’s underlying assets; and difficulty withdrawing funds.

Due diligence is crucial. Thoroughly research any cryptocurrency investment opportunity before committing funds. Verify the legitimacy of the project, its team, and its claims. Be wary of promises that sound too good to be true, as they often are.

Protecting yourself from crypto Ponzi schemes requires a healthy dose of skepticism and a commitment to thorough research. Remember that consistent, sustainable returns require time and careful planning, not unrealistic promises of overnight riches.

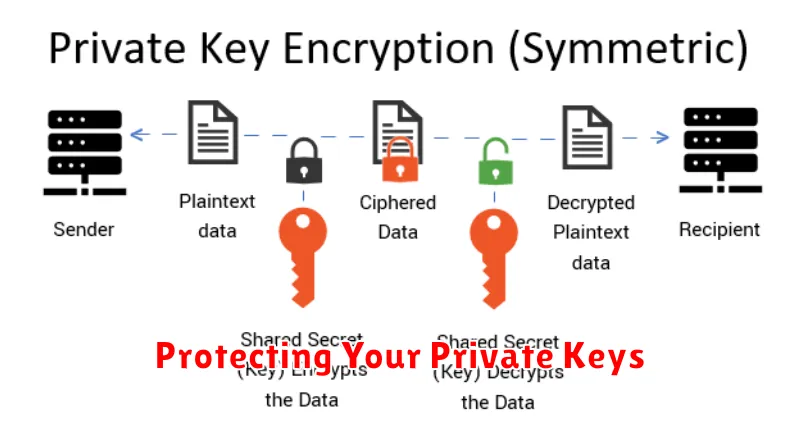

Protecting Your Private Keys

Private keys are the foundation of your cryptocurrency security. They are essentially passwords granting you access to your digital assets. Losing or compromising them means losing irretrievable access to your funds.

Never share your private keys with anyone, including customer support representatives. Legitimate companies will never ask for them. Be wary of phishing attempts disguised as official communications.

Store your private keys securely. Avoid storing them digitally on easily accessible devices like computers or phones. Consider hardware wallets, which offer enhanced security through offline storage.

Regularly back up your keys, but do so securely. Use multiple methods and store backups in physically separate, safe locations. Consider employing encryption for added protection.

Use strong, unique passwords and enable two-factor authentication (2FA) wherever possible to add an extra layer of security to your cryptocurrency accounts and exchanges.

Be cautious of unfamiliar websites and applications claiming to offer cryptocurrency services. Verify their legitimacy before providing any personal or sensitive information, including your private keys.

Educate yourself continuously about cryptocurrency security best practices. Staying informed is crucial in protecting your digital assets from theft.

Best Security Practices for Crypto Trading

Secure your hardware and software: Employ strong, unique passwords for all your accounts, enable two-factor authentication (2FA) wherever possible, and keep your operating system and antivirus software updated.

Choose reputable exchanges: Research and select cryptocurrency exchanges with a strong track record of security and regulatory compliance. Avoid lesser-known platforms with questionable security practices.

Practice good key management: Never share your private keys with anyone, and store them securely offline using hardware wallets or other secure methods. Treat your private keys like your bank account passwords – losing them means losing your assets.

Be wary of phishing scams: Never click on suspicious links or download attachments from unknown sources. Legitimate exchanges and platforms will never ask for your private keys or seed phrases.

Diversify your investments: Avoid putting all your eggs in one basket. Spread your investments across various cryptocurrencies to mitigate risk.

Stay informed: Keep up-to-date on the latest security threats and best practices. Regularly review your account activity for any suspicious transactions.

Use a VPN: A Virtual Private Network (VPN) can encrypt your internet connection, adding an extra layer of security, especially when trading on public Wi-Fi networks.

Regularly back up your data: Back up your wallet seed phrases, passwords, and other crucial information in a secure, offline location. Consider using multiple backup methods.

Only use verified communication channels: Communicate with exchanges and support teams only through their official websites or verified contact methods.

Using Cold Wallets for Extra Protection

Cold wallets offer a significant layer of security for your cryptocurrency holdings. Unlike hot wallets (online wallets), cold wallets are offline devices, making them immune to most online threats like phishing and hacking.

These devices, typically hardware devices resembling USB drives, store your private keys offline. This significantly reduces the risk of your funds being stolen through malicious software or unauthorized access to your online accounts.

While cold wallets require a slightly more involved process for transactions, the enhanced security they provide is invaluable for protecting your crypto assets. Consider a cold wallet as an extra insurance policy against the ever-present risks in the digital world.

Choosing a reputable cold wallet provider is crucial. Research thoroughly and select a device with a strong security reputation and a proven track record.

Reporting Crypto Scams to Authorities

Reporting a crypto scam is crucial to protecting yourself and others. Gather all relevant information, including communication logs, transaction details, and the scammer’s contact information. This will aid investigators.

Next, file a report with your local law enforcement agency. Many agencies have dedicated cybercrime units experienced in handling these types of cases. Simultaneously, report the scam to the relevant regulatory bodies in your jurisdiction. These often include agencies focused on consumer protection and financial crimes.

Report the scam to the platform(s) where the activity occurred. Exchanges and other cryptocurrency platforms often have procedures for reporting fraudulent activity. Providing detailed information about the scam helps them identify and prevent future occurrences.

Finally, consider reporting the scam to the Federal Trade Commission (FTC) in the US or the equivalent agency in your country. The FTC maintains a database of reported scams which helps them identify trends and prosecute perpetrators.

Remember to keep detailed records of all your reports and communications. While recovering your losses might be challenging, reporting helps protect others from becoming victims.