Are you looking to maximize your cryptocurrency earnings? Choosing the right mining pool is crucial for success. This article explores the best mining pools available, comparing factors such as hashrate distribution, fees, payout methods, and overall profitability to help you select the optimal pool for maximum returns on your mining investment. Discover which pools offer the highest payouts and the most reliable service, ensuring you get the most out of your crypto mining operations.

What Is a Mining Pool?

A mining pool is a group of cryptocurrency miners who combine their computing power to increase their chances of successfully mining a block and earning the associated block reward.

Instead of individual miners competing against each other, they pool their resources. When a block is successfully mined, the reward is distributed among the pool members proportionally to their contributed hashrate.

Joining a mining pool significantly increases the frequency of earning rewards, making it a more reliable and predictable income stream compared to solo mining, especially for miners with limited computing power. The pool fee, a percentage deducted from the rewards, is a consideration when choosing a pool.

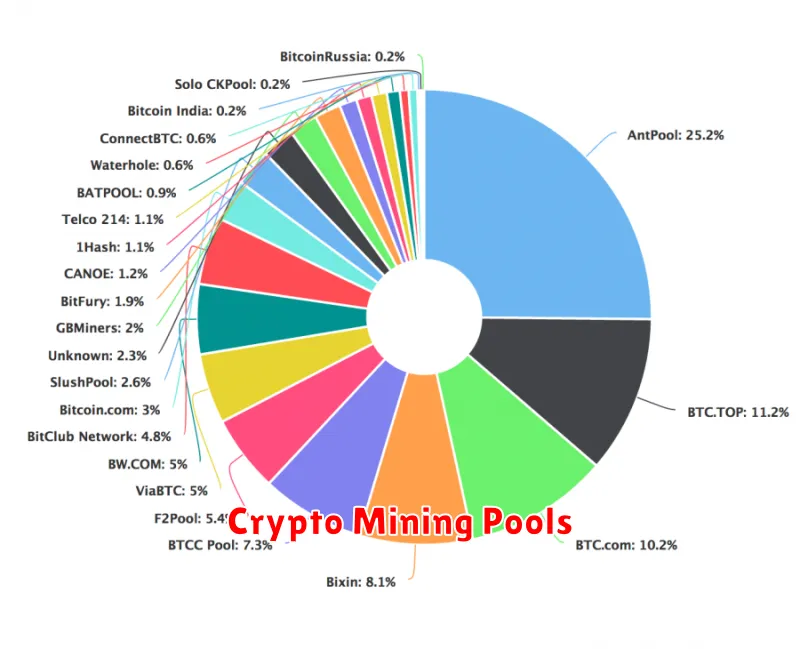

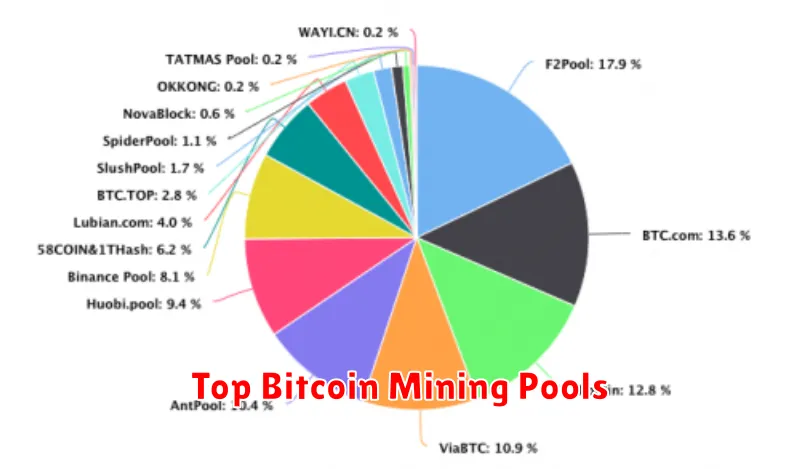

Top Bitcoin Mining Pools

Choosing the right Bitcoin mining pool is crucial for maximizing your earnings. Profitability depends on several factors, including pool fees, block rewards, and the pool’s overall hash rate.

AntPool is consistently ranked among the largest, boasting high hashing power and a relatively low fee structure. However, its size can lead to higher competition for block rewards.

Binance Pool, backed by the major cryptocurrency exchange, offers competitive fees and a user-friendly interface. Its popularity ensures a steady stream of blocks.

Poolin is known for its global reach and support for various cryptocurrencies. While it may not always be the most profitable, its diversity provides options.

ViaBTC, another large pool, provides a solid balance between fees, hashing power, and reward distribution. Consider their payment systems before joining.

F2Pool is a long-standing pool with a proven track record. It’s worth considering for its experience and established infrastructure. It’s crucial to research fees and payment methods carefully before selecting any pool.

Remember that the best pool for you may vary based on your hashing power and risk tolerance. Regularly monitoring your chosen pool’s performance is recommended for optimal earnings.

Best Altcoin Mining Pools

Choosing the right altcoin mining pool is crucial for maximizing your earnings. Several factors influence profitability, including pool fees, payout methods, and the pool’s overall hashrate and block rewards.

Top contenders often include those with a proven track record of consistent payouts, low fees, and a large, active community. Research is key; examine each pool’s individual statistics before committing your hashing power.

Consider factors like the pool’s algorithm support. Ensure it aligns with the specific altcoin you plan to mine. Also look at the minimum payout thresholds and the frequency of payouts. These details significantly impact your overall return.

Remember that the cryptocurrency mining landscape is dynamic. Pool performance can fluctuate, so continuous monitoring and occasional adjustments to your mining strategy might be necessary to optimize your earnings.

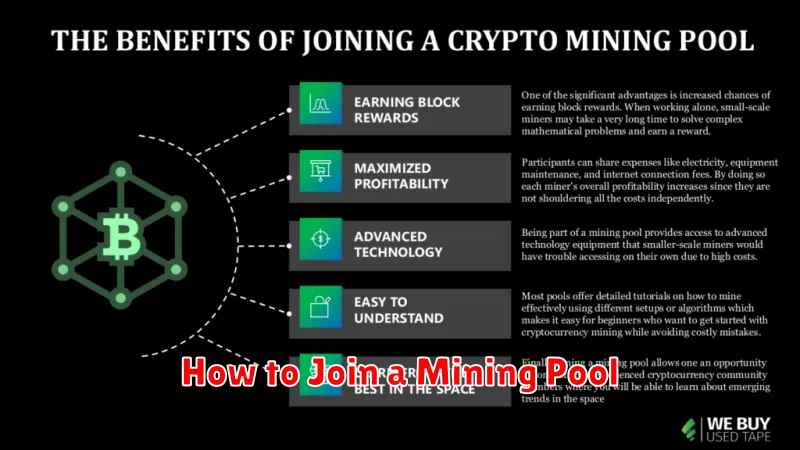

How to Join a Mining Pool

Joining a mining pool is a straightforward process, although the specific steps may vary slightly depending on the chosen pool. Generally, you’ll first need to create an account on the pool’s website. This usually involves providing an email address and choosing a password.

Next, you’ll need to configure your mining software to connect to the pool’s servers. This involves entering the pool’s address (often a URL or IP address) and your worker name (a unique identifier for your mining rig). Your mining software will then submit your hashing power to the pool.

Some pools may require you to specify your payment method and wallet address during the signup process or within your account settings. This ensures your earned cryptocurrency is transferred to the correct location.

Finally, start your mining software. Once connected to the pool, your mining rig will begin contributing to the collective hashing power and earning rewards, which are typically paid out based on your contribution and the pool’s payout system (e.g., proportional, PPS, PPLNS).

Remember to regularly check your pool account to monitor your earnings and ensure everything is working correctly. Consult the chosen pool’s documentation for specific instructions and troubleshooting advice.

Comparing Pool Fees and Payout Structures

Choosing the right mining pool significantly impacts your profitability. Pool fees are a crucial factor, varying between pools and often expressed as a percentage of your mined rewards. Some pools charge a fixed fee, while others may use a tiered system based on your hashing power. Lower fees directly translate to higher earnings.

Payout structures also play a vital role. Common methods include Pay Per Share (PPS), Pay Per Last N Shares (PPLNS), and Full Pay Per Share (FPPS). PPS offers immediate payment for each share submitted, guaranteeing consistent payouts regardless of block finds. However, the pool bears the risk. PPLNS pays based on your contribution to the block that was solved. This structure can lead to higher payouts if you participate in a successful block but less consistent income. FPPS combines aspects of PPS and PPLNS, providing a balance.

Understanding the nuances of these structures is crucial. A pool with a slightly higher fee might offer a payout structure that better suits your mining strategy, ultimately leading to higher net earnings. Carefully compare fees and payout models before selecting a pool to maximize your returns.

Which Mining Pool Offers the Best Rewards?

There’s no single answer to which mining pool offers the best rewards. The optimal choice depends on several factors, including the specific cryptocurrency you’re mining, your hashing power, and your risk tolerance.

Larger pools generally offer more frequent payouts due to higher block discovery rates. However, they may also have higher fees. Smaller pools might offer lower fees and potentially higher per-share rewards but with increased payout variability due to less frequent block finds.

Payout systems also vary. Some pools use proportional payouts, distributing rewards based on your contribution to the pool’s total hash rate. Others utilize a PPS (Pay Per Share) system guaranteeing payment for each share submitted, regardless of whether the pool finds a block. PPS offers more predictable income but usually comes with higher fees.

Ultimately, comparing the fee structures and historical payout data across multiple pools, considering your individual mining setup, will help you determine which offers the best rewards for your specific circumstances.