Are you intrigued by the world of cryptocurrency and eager to learn how to participate? This beginner’s guide on how to start mining Bitcoin will equip you with the fundamental knowledge and steps required. We’ll cover essential aspects, including choosing the right mining hardware, understanding Bitcoin mining software, selecting a mining pool, and managing electricity costs. Learn the intricacies of Bitcoin mining profitability and navigate potential challenges to successfully begin your Bitcoin mining journey.

What is Bitcoin Mining?

Bitcoin mining is the process of verifying and adding transactions to the Bitcoin blockchain. Miners use powerful computers to solve complex mathematical problems. The first miner to solve the problem adds the next block of transactions to the blockchain and receives a reward in Bitcoin.

This process is crucial for maintaining the security and integrity of the Bitcoin network. It ensures that transactions are verified and prevents double-spending of Bitcoins. The computational power required for mining contributes to the overall security of the system, making it incredibly difficult to alter the blockchain’s history.

The reward for mining Bitcoins is halved approximately every four years, a process known as halving. This built-in mechanism controls the rate of new Bitcoin creation, ensuring a degree of scarcity and potentially influencing the value of the cryptocurrency over time.

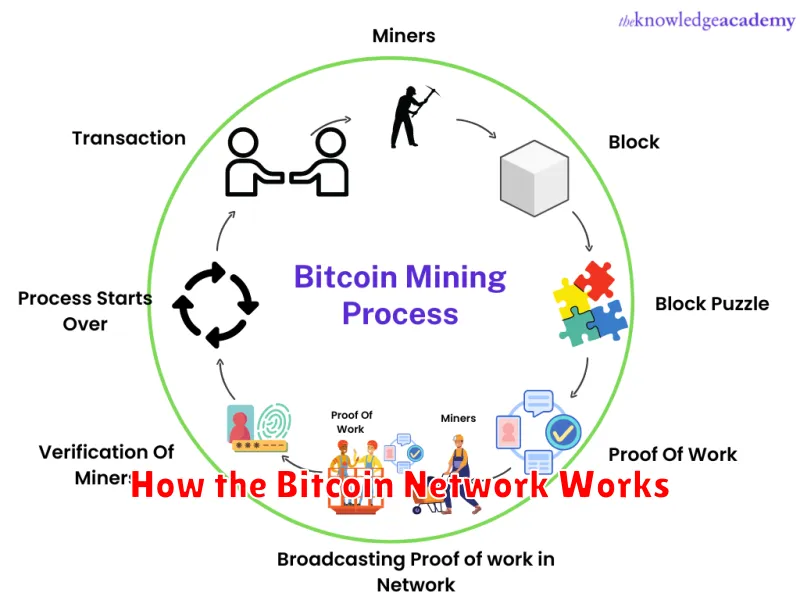

How the Bitcoin Network Works

The Bitcoin network is a decentralized system, meaning it’s not controlled by any single entity. Instead, it relies on a global network of computers (nodes) that collectively maintain a shared blockchain.

This blockchain is a public, digital ledger recording every Bitcoin transaction. Each transaction is grouped into a block, which is then added to the chain after being verified by the network through a process called mining.

Mining involves solving complex cryptographic puzzles. The first miner to solve a puzzle adds the next block to the blockchain and is rewarded with newly created Bitcoins and transaction fees. This process secures the network and prevents fraudulent transactions.

The network’s consensus mechanism, known as Proof-of-Work, ensures that the blockchain remains consistent and secure. The majority of nodes must agree on the validity of each block before it’s added to the chain. This prevents manipulation and maintains the integrity of the Bitcoin system.

In essence, the Bitcoin network functions as a distributed database, with many computers working together to validate and record transactions in a secure and transparent manner.

Best Bitcoin Mining Hardware

Choosing the right hardware is crucial for successful Bitcoin mining. Application-Specific Integrated Circuits (ASICs) are currently the most efficient and widely used devices for Bitcoin mining. They are specifically designed for this purpose, offering significantly higher hash rates compared to CPUs or GPUs.

Leading manufacturers of Bitcoin mining ASICs include Bitmain and MicroBT. Their products vary in terms of hash rate, power consumption, and price. Hash rate indicates the computational power of the miner, directly affecting your earning potential. Power consumption is a significant factor, impacting electricity costs.

When selecting hardware, consider factors beyond just the hash rate. Examine the power efficiency (measured in Joules per terahash, J/TH), noise levels, and reliability of the miner. Research reviews and compare specifications from different models before making a purchase. The best hardware for you will depend on your budget and mining operation scale.

It’s also important to note that the Bitcoin mining landscape is dynamic. The difficulty of mining constantly adjusts, making older hardware less profitable over time. Therefore, always research current market conditions and the performance of available ASICs before investing.

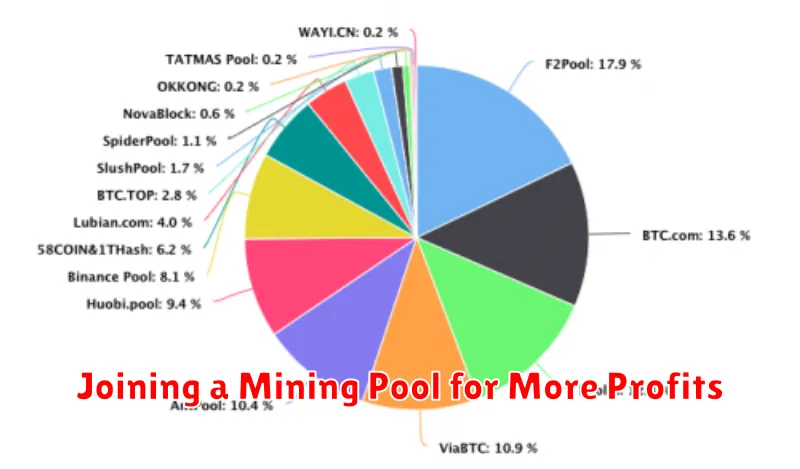

Joining a Mining Pool for More Profits

Solo Bitcoin mining is incredibly difficult and often unprofitable for individuals due to the immense computational power required. Joining a mining pool significantly increases your chances of earning Bitcoin. A mining pool combines the hashing power of many miners, allowing the group to solve blocks more frequently and share the rewards proportionally based on each member’s contribution.

The profitability of mining pools varies depending on factors such as pool fees, the difficulty of mining, and the current Bitcoin price. While you won’t earn a full block reward as a solo miner, the consistent, smaller payouts from a pool generally offer much greater returns, particularly for those with limited hashing power.

When choosing a pool, consider factors like the pool’s size and hashrate (larger pools generally have more consistent payouts), the fee structure, and the payment method. Research different pools to find one that best suits your needs and mining setup.

Joining a mining pool is a crucial step for most beginners aiming for consistent Bitcoin mining profits. It significantly improves the probability of receiving rewards and makes the process more sustainable.

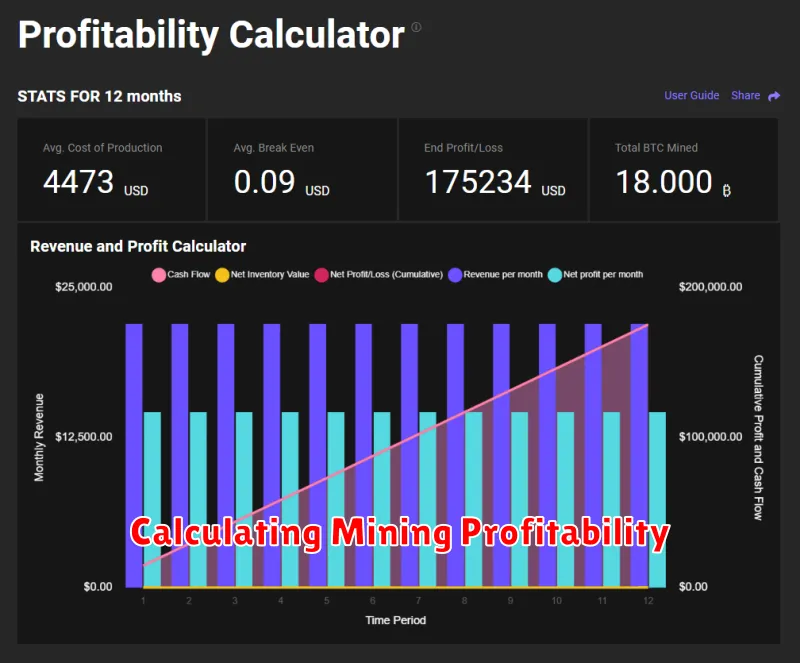

Calculating Mining Profitability

Before investing in Bitcoin mining, accurately calculating profitability is crucial. Several key factors influence profitability: hardware costs (ASIC miners), electricity costs, mining difficulty, and the current Bitcoin price.

Hardware costs include the initial purchase price and potential maintenance or replacement expenses. Electricity costs are a significant ongoing expense, as miners consume substantial power. The mining difficulty, a measure of how competitive the mining network is, directly impacts the rewards. A higher difficulty means less frequent payouts. Finally, the Bitcoin price fluctuates significantly, directly affecting your potential profits.

Numerous online mining profitability calculators are available. These tools typically require you to input your hardware’s hash rate, power consumption, electricity cost, and pool fees to estimate your daily, weekly, or monthly profits. Remember that these are estimates; actual profitability can vary based on the factors mentioned above.

It’s essential to conduct thorough research and use multiple calculators to get a well-rounded view of potential profitability. Conservative estimates are advisable, considering potential fluctuations in electricity prices, Bitcoin’s value, and mining difficulty adjustments.

Future of Bitcoin Mining After the Next Halving

The next Bitcoin halving, scheduled for 2024, will reduce the block reward miners receive by half. This will significantly impact the profitability of Bitcoin mining.

Several factors will determine the future of mining post-halving. Increased mining difficulty is expected, meaning miners will need more powerful and energy-efficient hardware to remain competitive. The price of Bitcoin will play a crucial role; a rising price could offset the reduced block reward, maintaining profitability. Conversely, a falling price could make mining unprofitable for many.

Energy costs will also remain a key factor. Miners in regions with cheap and abundant energy sources will have a competitive advantage. The adoption of more sustainable energy sources by mining operations could become increasingly important for long-term viability.

Ultimately, the future of Bitcoin mining after the next halving is uncertain. It will depend on a complex interplay of technological advancements, economic conditions, and regulatory landscapes. Only miners with efficient operations and access to cheap power are likely to survive.