The evolution of blockchain technology has been nothing short of revolutionary, transforming how we think about data security, decentralization, and trust. From its humble beginnings as the underlying technology for Bitcoin, blockchain has rapidly expanded into a diverse landscape of applications, impacting various industries including finance, supply chain management, healthcare, and voting systems. This exploration delves into the key milestones, innovations, and future potential of this transformative technology, highlighting its impact on the digital economy and its implications for the future.

What Is Blockchain Technology?

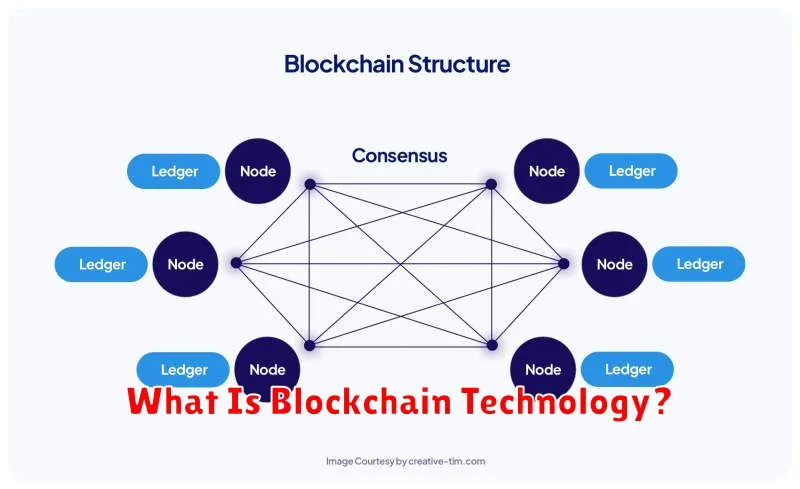

Blockchain technology is a decentralized, distributed, and public digital ledger that records and verifies transactions across multiple computers. This eliminates the need for a central authority, such as a bank or government.

Each transaction is grouped into a block, which is then added to the existing chain of blocks. This chain is secured through cryptography, making it virtually tamper-proof. Once a block is added to the chain, it cannot be altered or deleted.

The decentralized nature of blockchain ensures transparency and security, as no single entity controls the data. This feature fosters trust and reduces the risk of fraud or manipulation.

Key characteristics of blockchain technology include immutability, transparency, security, and decentralization. These features make it suitable for a wide range of applications beyond cryptocurrencies, including supply chain management, healthcare, and voting systems.

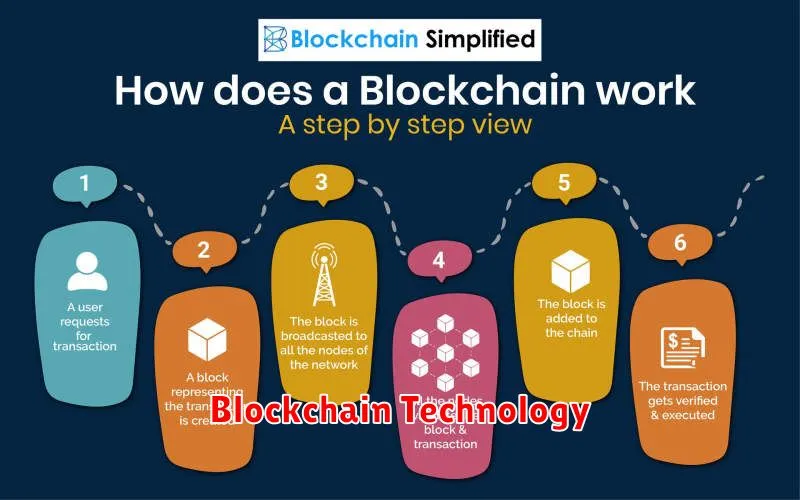

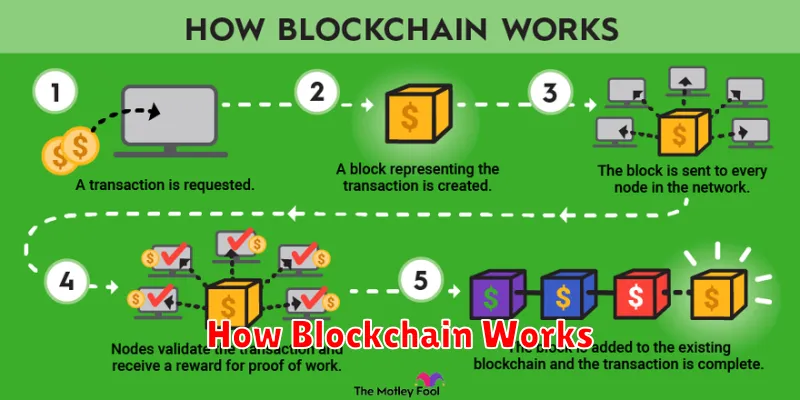

How Blockchain Works

At its core, a blockchain is a distributed, immutable ledger. This means that the record of transactions is not stored in a single location, but rather across a network of computers (nodes).

Each transaction is grouped into a block. Once a block is filled with transactions, it’s added to the chain, creating a chronological record. The blocks are linked cryptographically, ensuring the integrity of the entire chain. If someone tries to alter a past transaction, it would break the cryptographic link and be immediately detected by the network.

Consensus mechanisms, such as Proof-of-Work or Proof-of-Stake, are used to validate and add new blocks to the chain. These mechanisms ensure that all nodes agree on the state of the blockchain, maintaining its security and accuracy. This distributed nature and cryptographic linking makes a blockchain highly resistant to tampering and fraud.

Smart contracts, self-executing contracts with the terms of the agreement written directly into code, can be built on top of blockchain technology, automating agreements and transactions.

The Rise of Smart Contracts

The evolution of blockchain technology has witnessed a significant rise in the adoption and utilization of smart contracts. These self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code are revolutionizing various industries.

Initially conceptualized by Nick Szabo in the 1990s, smart contracts found their practical implementation with the advent of blockchain technology. The decentralized and immutable nature of blockchain provides the perfect environment for secure and transparent execution of these contracts.

Smart contracts automate agreements, eliminating intermediaries and reducing the risk of fraud. They enable trustless transactions between parties who may not know each other, facilitating a new level of efficiency and transparency.

The applications of smart contracts are vast, ranging from supply chain management and finance (e.g., decentralized finance or DeFi) to digital identity and voting systems. Their potential to disrupt traditional processes and unlock new business models is immense.

Despite their potential, smart contracts also face challenges. Security vulnerabilities, legal ambiguities, and scalability issues remain areas of ongoing development and refinement. However, as the technology matures, these challenges are being addressed, paving the way for even wider adoption.

Layer-2 Scaling Solutions for Faster Transactions

The inherent limitations of blockchain technology, particularly its transaction speed and scalability, have driven the development of Layer-2 scaling solutions. These solutions aim to alleviate congestion on the main blockchain (Layer-1) by processing transactions off-chain, significantly improving transaction throughput and reducing latency.

Several prominent Layer-2 scaling techniques exist. State channels allow for multiple transactions to occur off-chain before being settled on Layer-1, minimizing on-chain activity. Rollups bundle many transactions into a single transaction for cheaper and faster processing on Layer-1. They further subdivide into optimistic rollups, which assume transactions are valid unless proven otherwise, and zero-knowledge rollups (ZKRs), which provide stronger privacy guarantees through cryptographic proofs.

The choice of Layer-2 solution depends on the specific needs of a blockchain application. State channels are ideal for frequent interactions between a small number of parties, while rollups are better suited for applications requiring higher throughput and broader participation. The ongoing development and refinement of these techniques promise to further enhance blockchain’s capacity for handling large transaction volumes and maintaining fast transaction speeds, thereby unlocking its full potential for widespread adoption.

Blockchain in the Financial Sector

The financial sector is experiencing a significant transformation driven by blockchain technology. Its decentralized and secure nature offers numerous advantages, leading to increased efficiency and trust.

Improved transaction processing is a key benefit. Blockchain’s distributed ledger eliminates the need for intermediaries, resulting in faster and cheaper transactions. This is particularly impactful for international payments and cross-border settlements.

Enhanced security is another crucial aspect. The cryptographic nature of blockchain makes it highly resistant to fraud and data breaches, bolstering the security of financial records and assets.

Increased transparency is also achieved through the immutable nature of the blockchain. All transactions are recorded publicly and verifiably, enhancing accountability and reducing the risk of discrepancies.

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate processes and reduce the need for manual intervention, streamlining operations and minimizing errors.

Despite the potential, challenges remain. Regulatory uncertainty, scalability issues, and the need for widespread adoption are hurdles that need to be addressed for the full potential of blockchain in finance to be realized.

However, ongoing developments and innovations suggest a promising future for blockchain technology within the financial sector, paving the way for a more efficient, secure, and transparent financial ecosystem.

Decentralized Identity and Web3

Web3’s emergence signifies a paradigm shift from centralized online identities to decentralized identities. This transition leverages blockchain technology to grant individuals greater control over their personal data.

Instead of relying on centralized platforms like social media companies or email providers to manage identity verification, Web3 utilizes self-sovereign identity (SSI) solutions. This allows users to own and manage their digital identities, choosing which information to share and with whom.

Blockchain’s immutability ensures the integrity and security of these identities, making them resistant to manipulation and data breaches. Furthermore, decentralized identifiers (DIDs) and verifiable credentials (VCs) become crucial components in establishing trust and authentication in a decentralized environment.

The adoption of decentralized identities empowers users with increased privacy, security, and control over their digital lives. It fundamentally alters the relationship between individuals and online platforms, paving the way for a more transparent and user-centric internet.

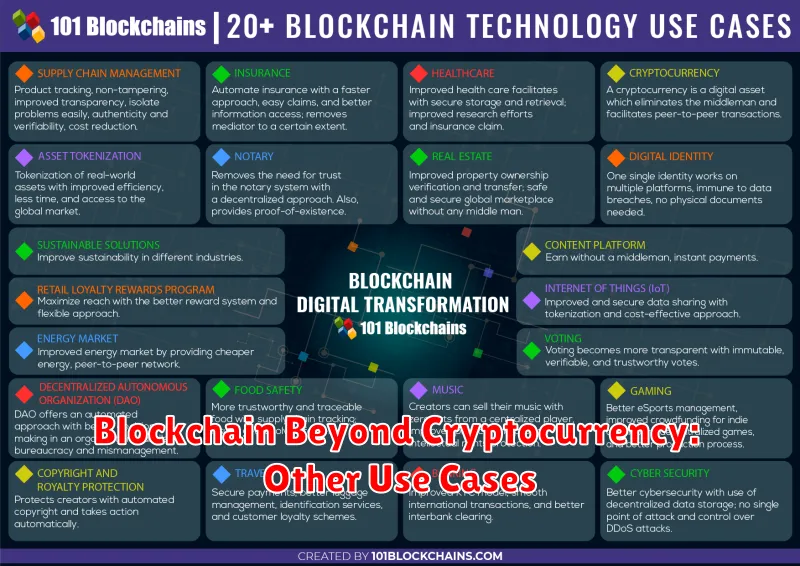

Blockchain Beyond Cryptocurrency: Other Use Cases

While cryptocurrency is a prominent application of blockchain technology, its potential extends far beyond digital currencies. Supply chain management benefits significantly, using blockchain to create transparent and tamper-proof records of product movement, enhancing traceability and accountability. This improves efficiency and combats counterfeiting.

Healthcare is another area ripe for blockchain’s transformative power. Securely storing and sharing patient medical records on a blockchain ensures data privacy and interoperability between different healthcare providers. This streamlined access improves the quality and efficiency of care.

Digital identity verification is revolutionized through blockchain. It offers a decentralized, secure, and verifiable way to manage identities, reducing fraud and simplifying processes like online authentication and KYC (Know Your Customer) compliance.

Voting systems can leverage blockchain’s immutability to enhance transparency and security. A blockchain-based voting system could provide a verifiable audit trail, reducing the risk of fraud and increasing voter confidence.

Intellectual property rights management also benefits from blockchain. Artists and creators can use blockchain to register and prove ownership of their work, making it easier to protect their intellectual property and track usage.

These diverse applications showcase blockchain’s versatility and capacity to revolutionize numerous industries. Its underlying principles of decentralization, transparency, and security are driving its adoption across sectors beyond cryptocurrency.

The Future of Blockchain Technology

The future of blockchain technology is brimming with potential. Scalability remains a key challenge, with solutions like sharding and layer-2 scaling protocols actively being developed to address transaction throughput limitations. Interoperability, enabling different blockchain networks to communicate seamlessly, is another crucial area of development, fostering greater ecosystem integration.

Beyond cryptocurrency, decentralized finance (DeFi) is poised for significant growth, offering innovative financial services accessible to a wider audience. Supply chain management and digital identity verification are also promising sectors, where blockchain’s inherent transparency and security can revolutionize processes and build trust.

Regulation will play a vital role in shaping the future of blockchain. Clearer regulatory frameworks are needed to foster innovation while mitigating risks. The increasing integration of artificial intelligence (AI) and machine learning (ML) with blockchain technologies promises to enhance efficiency and security further. Overall, the future of blockchain is dynamic and multifaceted, with enormous potential to transform various industries.