Are you interested in learning how to mine cryptocurrency but worried about the high initial investment costs? This comprehensive guide details effective strategies for cryptocurrency mining with minimal investment, exploring options such as cloud mining, joining a mining pool, and leveraging low-cost hardware. Discover how to maximize your returns while minimizing your financial risk in the exciting world of cryptocurrency mining with this practical, step-by-step approach.

What is Low-Cost Crypto Mining?

Low-cost cryptocurrency mining refers to the process of earning cryptocurrencies with minimal upfront investment. This typically involves using readily available, relatively inexpensive hardware like older GPUs or joining a cloud mining service that shares mining resources. While profitability might be lower compared to high-end setups, it allows individuals with limited capital to participate in cryptocurrency mining and potentially earn passive income.

The key to low-cost mining is efficiency and strategic selection. Choosing less energy-intensive cryptocurrencies to mine and optimizing hardware utilization are critical factors in maximizing returns while keeping costs down. Understanding the current market conditions and mining difficulty is also essential to determine the viability and potential profitability of such an endeavor.

It’s important to note that even low-cost mining involves ongoing operational costs, such as electricity bills and potential hardware maintenance or replacement. Therefore, thorough research and careful planning are crucial before embarking on this venture. Realistic expectations about profitability are also vital to avoid disappointment.

Best Budget-Friendly Mining Rigs

Building a profitable cryptocurrency mining rig on a budget requires careful consideration of hardware choices. ASIC miners, while generally more efficient for Bitcoin mining than GPUs, often come with a higher upfront cost. For beginners or those with limited budgets, focusing on less energy-intensive cryptocurrencies like Ethereum Classic (ETC) or Ravencoin (RVN) mined using GPUs is often more viable.

A budget-friendly GPU mining rig might utilize used or refurbished GPUs, significantly reducing the initial investment. Prioritize cards like the AMD RX 570 or RX 580, known for their relatively low power consumption and decent hashrates for certain algorithms. Remember to factor in the cost of a motherboard with sufficient PCIe slots, a CPU (an older model will suffice), RAM (8GB is often enough), a power supply capable of handling the GPUs’ power demands, and a suitable case.

Efficient cooling is crucial. A well-ventilated case and potentially additional case fans are essential to prevent overheating and maintain optimal performance. It’s also important to consider power consumption; monitoring your rig’s energy usage and comparing it to your potential earnings is vital for profitability. Finally, mining profitability changes rapidly. Thorough research on current cryptocurrency prices and mining difficulty is essential to ensure your investment is worthwhile.

How Cloud Mining Can Reduce Costs

Traditional cryptocurrency mining requires significant upfront investment in specialized hardware like ASICs or GPUs, along with substantial ongoing costs for electricity, cooling, and maintenance. These expenses can quickly outweigh the potential profits, especially for smaller-scale miners.

Cloud mining offers a cost-effective alternative. Instead of purchasing and maintaining your own equipment, you rent hashing power from a cloud mining provider. This eliminates the need for expensive hardware purchases and reduces or eliminates electricity and maintenance costs. You only pay for the hashing power you use, making it a much more accessible entry point for cryptocurrency mining.

However, it’s crucial to carefully research and select a reputable provider. Transparency regarding fees, hashing power, and contract terms is paramount. Be wary of overly promising returns, as these can be indicative of scams. Choosing a trustworthy provider is vital to minimizing costs and maximizing your chances of profitability.

While cloud mining reduces initial capital outlay and ongoing operational costs, it’s essential to understand that you are still subject to market volatility and the inherent risks associated with cryptocurrency mining. Profitability depends on various factors including the cryptocurrency’s price, mining difficulty, and the chosen provider’s performance.

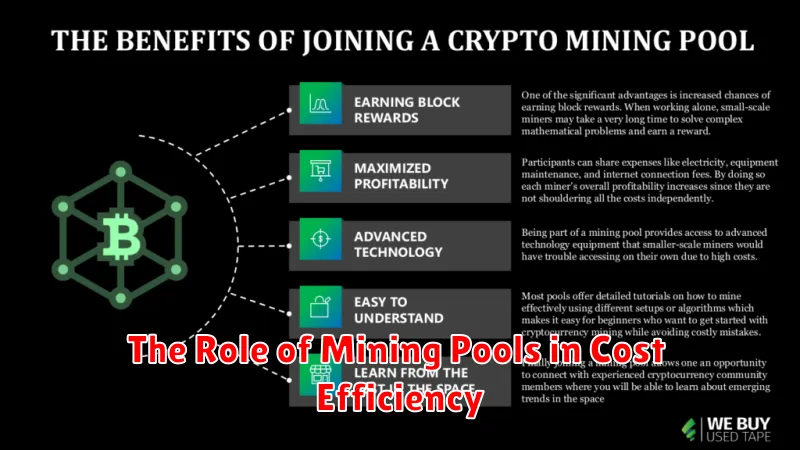

The Role of Mining Pools in Cost Efficiency

Mining cryptocurrency individually can be incredibly expensive, requiring significant upfront investment in hardware and substantial electricity costs. The probability of successfully mining a block solo is also extremely low.

Mining pools address these issues by aggregating the computing power of many miners. This collective effort significantly increases the chance of solving a block and earning a reward. The reward is then distributed among pool members proportionally to their contributed hashrate.

This shared approach dramatically improves cost efficiency. Miners reduce their individual risk and operational expenses, while enjoying a more consistent and predictable income stream. The economies of scale achieved through pooled mining make it a far more viable option for individuals with limited resources.

However, it’s crucial to note that while mining pools offer significant cost advantages, they also involve a degree of centralization and a potential reduction in individual control and reward variability compared to solo mining.

Is Crypto Mining Still Profitable in 2025?

The profitability of cryptocurrency mining in 2025 is highly uncertain and depends on several interconnected factors.

Cryptocurrency price: A significant rise in the price of the cryptocurrency being mined is crucial for profitability. Conversely, a price drop can quickly erase any profit margins.

Mining difficulty: As more miners join the network, the difficulty of mining increases, requiring more powerful hardware and consuming more energy to earn the same rewards. This directly impacts profitability.

Electricity costs: Mining is energy-intensive. High electricity prices can drastically reduce or eliminate profits, making it unsustainable in many regions.

Hardware costs and lifespan: The initial investment in mining hardware (ASICs or GPUs) is substantial. Their lifespan and potential for obsolescence must be considered when calculating long-term profitability. The return on investment (ROI) needs to be calculated considering depreciation.

Mining pool fees: Miners often join pools to increase their chances of finding a block. These pools charge fees, which affect the net profit.

In summary, while some cryptocurrencies might remain profitable to mine in 2025, it’s not guaranteed. Thorough research and a careful assessment of the above factors are essential before investing in cryptocurrency mining.