This ultimate beginner’s guide to cryptocurrency will demystify the world of digital currencies. Learn what cryptocurrency is, how it works, and why it’s become such a significant phenomenon. We’ll explore key concepts like blockchain technology, Bitcoin, mining, and crypto wallets, providing a clear and concise understanding of this rapidly evolving investment landscape. Whether you’re a complete novice or simply curious about cryptocurrencies like Ethereum and others, this guide will equip you with the foundational knowledge you need to navigate the exciting world of digital assets.

Understanding Digital Currencies

Digital currencies, at their core, are electronic representations of value. Unlike traditional currencies issued and regulated by governments (fiat currencies), they are typically decentralized and operate independently of central banks. This decentralization is often achieved through cryptographic techniques and distributed ledger technology, making them resistant to certain forms of fraud and manipulation.

Key characteristics of digital currencies include their ability to be transferred electronically, often peer-to-peer, without intermediaries like banks. This can lead to faster and potentially cheaper transactions. However, it’s important to note that the value of digital currencies can be extremely volatile, subject to significant price fluctuations driven by market speculation and other factors.

There are various types of digital currencies, each with its own unique characteristics and functionalities. Cryptocurrencies, a subset of digital currencies, use cryptography to secure transactions and control the creation of new units. Others may be backed by a central entity or a commodity, unlike decentralized cryptocurrencies which are based on a consensus mechanism.

Understanding the underlying technology and the potential risks associated with digital currencies is crucial before engaging with them. The lack of regulation in some jurisdictions and the potential for scams highlight the importance of due diligence and careful consideration.

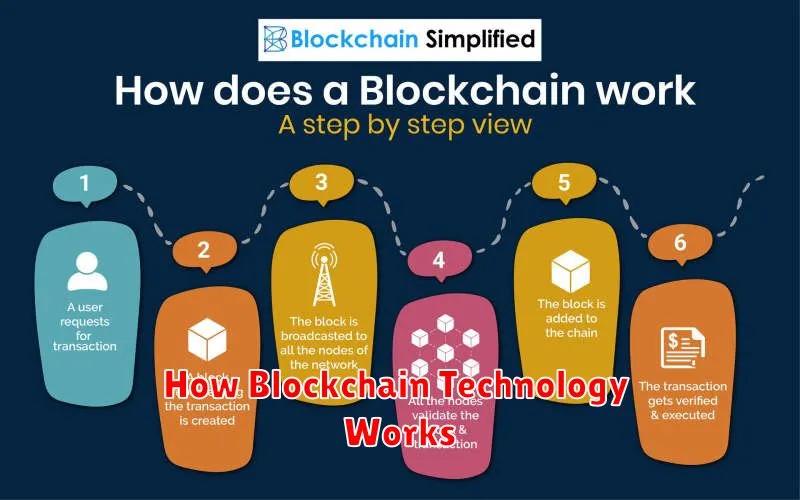

How Blockchain Technology Works

At its core, a blockchain is a distributed, immutable ledger. Imagine a digital record-keeping system shared among many computers (nodes) across a network. Each transaction is grouped into a “block” and added to the existing chain of blocks chronologically.

Decentralization is key. No single entity controls the blockchain; instead, it’s maintained collectively by the network of nodes. This eliminates single points of failure and enhances security.

Immutability means that once a block is added to the chain, it cannot be altered or deleted. Each block is linked cryptographically to the previous one, creating a secure and tamper-proof chain. Any attempt to change a past transaction would require altering all subsequent blocks, a computationally infeasible task.

Consensus mechanisms, like Proof-of-Work (PoW) or Proof-of-Stake (PoS), ensure that new blocks are added legitimately to the chain. These mechanisms verify transactions and add blocks, maintaining the integrity and security of the blockchain.

In essence, blockchain technology provides a transparent, secure, and reliable method for recording and verifying transactions without relying on a central authority. This trustless system is fundamental to the operation of cryptocurrencies.

The Role of Decentralization in Crypto

Decentralization is a core tenet of cryptocurrency, differentiating it from traditional financial systems. Unlike centralized systems controlled by a single entity (like a bank), cryptocurrencies operate on a distributed ledger technology (DLT), typically a blockchain.

This decentralized structure means no single person or organization controls the network. Transactions are verified and recorded across numerous computers, making the system highly resistant to censorship and single points of failure.

The absence of intermediaries, such as banks or payment processors, leads to faster and potentially cheaper transactions. It also enhances transparency, as all transactions are publicly viewable (though user identities are often pseudonymous).

However, decentralization also presents challenges. The lack of central control can lead to regulatory difficulties and security vulnerabilities if not properly managed. Scalability can also be an issue, as processing large numbers of transactions on a decentralized network can be slow and energy-intensive.

Types of Cryptocurrencies and Their Use Cases

Cryptocurrencies are broadly categorized based on their functionality and underlying technology. Bitcoin, the first and most well-known cryptocurrency, serves primarily as a store of value and a medium of exchange, though its volatility limits its practicality for everyday transactions.

Altcoins, or alternative cryptocurrencies, encompass a vast array of projects with diverse purposes. Ethereum, for example, is a platform for decentralized applications (dApps) and smart contracts, enabling developers to build innovative solutions on its blockchain. Other altcoins focus on privacy (e.g., Monero), scalability (e.g., Solana), or decentralized finance (DeFi) (e.g., various stablecoins and lending platforms).

Stablecoins are designed to maintain price stability, often pegged to a fiat currency like the US dollar. Their primary use case is to minimize the volatility associated with other cryptocurrencies, facilitating smoother transactions within the crypto ecosystem. Security tokens represent ownership in a real-world asset, such as stocks or real estate, offering a potentially more secure and transparent way to trade these assets.

The use cases for cryptocurrencies are constantly evolving. Beyond their roles as mediums of exchange and stores of value, they are increasingly employed in supply chain management, digital identity verification, and voting systems, among other applications. The specific use case of a given cryptocurrency often depends on its unique features and design.

How to Buy and Sell Crypto

Buying and selling cryptocurrency involves several steps. First, you need to choose a reputable cryptocurrency exchange. Research different platforms, comparing fees and security features before selecting one.

Next, you’ll need to create an account on your chosen exchange. This typically involves providing personal information and verifying your identity. After account verification, you can deposit funds. Most exchanges accept bank transfers or credit/debit cards.

Once your funds are deposited, you can buy cryptocurrency. Select the cryptocurrency you wish to purchase and enter the amount you want to buy. The exchange will then process the transaction. To sell cryptocurrency, you simply reverse the process. Select the cryptocurrency you own, enter the amount you wish to sell, and complete the transaction.

Security is paramount. Use strong passwords, enable two-factor authentication, and be wary of phishing scams. Store your cryptocurrency in a secure wallet, ideally a hardware wallet for maximum protection. Understand the risks involved; cryptocurrency markets are volatile, and prices can fluctuate significantly.

Remember to always conduct your own thorough research before investing in any cryptocurrency. Consider seeking advice from a qualified financial advisor if needed.

The Importance of Private Keys

In the world of cryptocurrency, private keys are paramount. They are essentially secret codes, unique to each cryptocurrency wallet, that grant you exclusive control over your digital assets.

Think of them as the key to your digital vault. Without your private key, you cannot access or spend the cryptocurrency held within your wallet. Losing your private key is equivalent to losing access to your funds—irrevocably.

Therefore, safeguarding your private key is of utmost importance. This involves storing it securely, preferably offline, and never sharing it with anyone. Compromising your private key can lead to the theft of your cryptocurrency.

The security of your cryptocurrency holdings directly hinges on the security of your private key. Prioritize its protection at all times.

Cold Wallets vs Hot Wallets

When it comes to storing your cryptocurrency, you have two main options: cold wallets and hot wallets. Understanding the difference is crucial for security.

A cold wallet is a device that is not connected to the internet. This makes it extremely difficult for hackers to access your funds. Examples include hardware wallets (physical devices like USB sticks) and paper wallets (printed private keys). Cold wallets offer the highest level of security but are less convenient for frequent transactions.

A hot wallet, conversely, is connected to the internet. This allows for easy access and quick transactions. Hot wallets can be software wallets (applications on your computer or phone) or exchange wallets (wallets provided by cryptocurrency exchanges). While convenient, hot wallets are more susceptible to hacks and malware.

The best choice depends on your individual needs and risk tolerance. If security is your top priority, a cold wallet is recommended. If convenience is more important, a hot wallet might suffice, but you should take extra precautions to secure your account and use strong passwords.

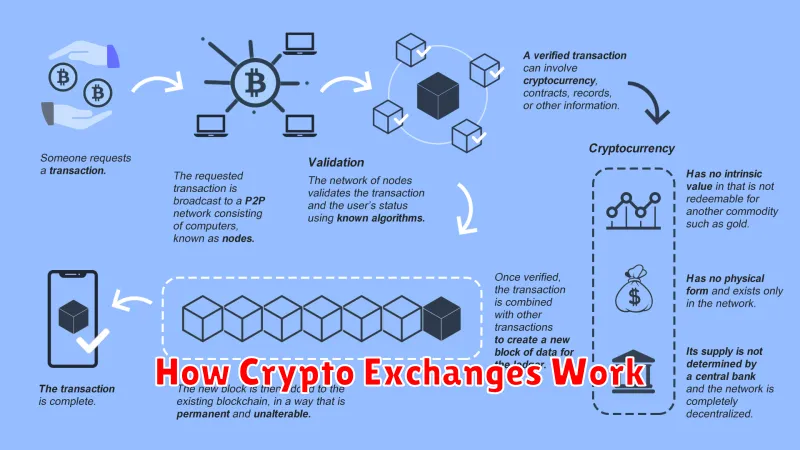

How Crypto Exchanges Work

Cryptocurrency exchanges are online platforms that allow users to buy, sell, and trade cryptocurrencies. They act as intermediaries, connecting buyers and sellers.

To use an exchange, you’ll first need to create an account and often verify your identity. This involves providing personal information to comply with regulations aimed at preventing money laundering and other illicit activities.

Next, you’ll need to deposit funds. Most exchanges accept fiat currencies (like USD or EUR) via bank transfers, debit/credit cards, or other payment methods. Some exchanges also allow direct cryptocurrency deposits.

Once your funds are available, you can browse available cryptocurrencies and place buy or sell orders. The price you pay or receive will depend on market conditions and the order type (market order, limit order, etc.).

After completing a trade, your cryptocurrency will be stored in your exchange wallet. While convenient, keeping large amounts of cryptocurrency on an exchange poses security risks. It’s generally recommended to transfer your holdings to a more secure personal wallet for long-term storage.

Fees are typically charged for deposits, withdrawals, and trades. These vary depending on the exchange and the cryptocurrency involved. It’s crucial to compare fees across different exchanges before selecting one.

Security is paramount when choosing a cryptocurrency exchange. Look for exchanges with robust security measures, including two-factor authentication (2FA) and other protective features. Researching an exchange’s reputation and history is also essential.

Crypto Mining vs Crypto Staking

Crypto mining and crypto staking are two distinct ways to earn cryptocurrency, each with its own set of requirements and rewards.

Mining involves solving complex mathematical problems to validate cryptocurrency transactions and add new blocks to the blockchain. This process requires specialized hardware (ASICs or powerful GPUs), significant electricity consumption, and substantial upfront investment. Rewards are typically new cryptocurrency added to the miner’s wallet.

Staking, on the other hand, involves locking up your existing cryptocurrency to help validate transactions on a proof-of-stake (PoS) blockchain. It requires holding a certain amount of cryptocurrency and participating in the network’s consensus mechanism. Staking typically offers passive income in the form of rewards distributed to stakers, without the significant energy consumption of mining.

In short, mining is energy-intensive and requires specialized hardware for potentially high rewards, while staking is a more passive and energy-efficient method for earning rewards with less upfront investment, but typically with lower returns.

Future Trends in Cryptocurrency

The future of cryptocurrency is dynamic and filled with potential. Several key trends are shaping its evolution. Increased Regulation is likely, aiming to balance innovation with consumer protection and prevent illicit activities. This will involve clearer legal frameworks and potentially licensing requirements.

Decentralized Finance (DeFi) will continue to expand, offering alternative financial services built on blockchain technology. This includes lending, borrowing, and trading without intermediaries, potentially disrupting traditional financial institutions. Interoperability between different blockchain networks is another crucial trend. This will allow seamless transfer of assets and data across various platforms, boosting efficiency and usability.

Central Bank Digital Currencies (CBDCs) are gaining traction globally. Many countries are exploring issuing their own digital currencies, potentially impacting the landscape of digital payments and financial systems. The adoption of Web3 technologies, including the Metaverse and NFTs (Non-Fungible Tokens), is also significantly influencing the cryptocurrency ecosystem. This integration expands the use cases of cryptocurrencies beyond mere digital assets.

Finally, Sustainability is becoming a key concern. The environmental impact of some cryptocurrencies is prompting innovations in energy-efficient consensus mechanisms and greener mining practices. The future of crypto will hinge on addressing these concerns and fostering responsible development.