Understanding crypto gas fees is crucial for navigating the world of blockchain transactions. These fees, which represent the cost of processing your transaction on a network like Ethereum, can significantly impact your overall crypto investment strategy. This article will delve into the intricacies of gas fees, explaining what they are, how they’re determined, and, most importantly, offering practical strategies to reduce costs and optimize your blockchain interactions. Learn how to minimize your expenses while efficiently transferring cryptocurrencies and interacting with decentralized applications (dApps).

What Are Crypto Gas Fees?

Crypto gas fees are transaction fees paid to miners or validators on a blockchain network to process and verify transactions. They are essentially the cost of using the network.

These fees are not fixed; they fluctuate based on network congestion. High demand (many transactions) leads to higher gas fees, while lower demand results in lower fees.

The amount of gas required depends on the complexity of the transaction. For example, a simple token transfer will generally cost less than a complex smart contract interaction.

Gas is measured in units specific to each blockchain (e.g., Gwei on Ethereum). The fee is calculated by multiplying the gas used by the current gas price (expressed in the blockchain’s native currency).

Paying these fees ensures your transaction is included in the next block, processed, and confirmed on the blockchain. Without sufficient gas, your transaction will likely fail.

Why Gas Fees Fluctuate

Gas fees on the Ethereum blockchain, and other similar networks, are dynamic and fluctuate based on several key factors. The most significant is network congestion. High demand, such as during periods of increased trading activity or popular NFT releases, leads to higher gas prices as users compete for transaction processing.

Transaction demand directly correlates with gas price. More transactions needing processing simultaneously drive up the price as miners prioritize higher-paying transactions. Conversely, lower network activity translates to lower fees.

The price of ETH also plays a role. While gas is paid in Gwei (a small unit of ETH), the overall value of ETH influences the perceived cost of transactions, impacting user willingness to pay higher fees.

Finally, the type of transaction influences gas costs. More complex transactions, requiring more computational power, incur higher gas fees than simpler ones.

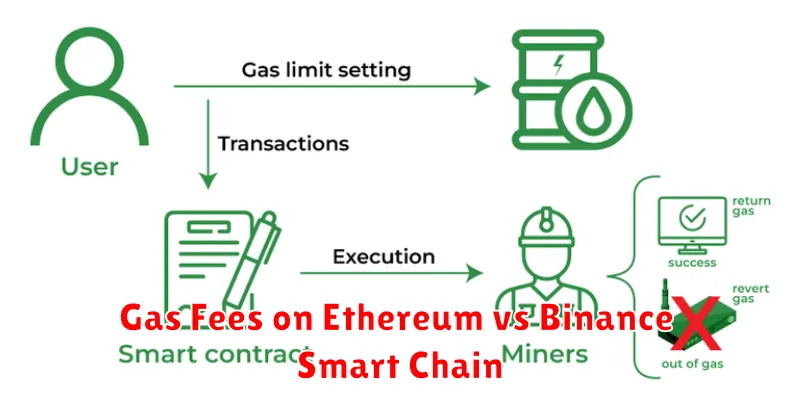

Gas Fees on Ethereum vs Binance Smart Chain

Ethereum and Binance Smart Chain (BSC) are both popular platforms for decentralized applications (dApps), but they differ significantly in their gas fee structures. Ethereum, a pioneer in blockchain technology, utilizes a Proof-of-Work (PoW) consensus mechanism, leading to higher transaction fees due to its complex and energy-intensive process. These fees can fluctuate wildly based on network congestion.

In contrast, BSC employs a Proof-of-Staked Authority (PoSA) consensus mechanism. This results in significantly lower and more stable gas fees compared to Ethereum. The reduced computational requirements contribute to faster transaction speeds and lower costs for users.

The choice between Ethereum and BSC often depends on the user’s priorities. Ethereum offers greater security and decentralization, albeit at a higher cost. BSC provides a more affordable and faster alternative, though with potentially less security and decentralization. Understanding these trade-offs is crucial for making informed decisions about which network to use for deploying and interacting with dApps.

How to Reduce Gas Fees When Trading

Gas fees, transaction costs on blockchain networks like Ethereum, can significantly impact your profitability. Several strategies can help mitigate these expenses.

Time your trades strategically. Network congestion often leads to higher gas fees. Trading during off-peak hours or on less busy days can result in substantial savings. Monitoring gas price trackers can help identify optimal times.

Adjust your transaction speed. Faster transactions generally incur higher gas fees. Opting for slower transaction speeds can significantly reduce your costs, though it will increase the time it takes for your trade to be processed.

Use a Layer-2 solution. Layer-2 scaling solutions, such as Polygon or Arbitrum, operate on top of the main blockchain, significantly reducing transaction fees. Transferring your assets to a Layer-2 network before trading can save you considerable amounts.

Batch transactions. Combining multiple transactions into a single batch reduces the overall gas cost per transaction. This is particularly beneficial when performing numerous trades simultaneously.

Choose the right network. Some blockchains have inherently lower gas fees than others. Consider using alternative networks with lower transaction costs when feasible.

Utilize tools and aggregators. Several platforms compare gas fees across different networks and help you find the most cost-effective option for your transactions. These tools can significantly simplify the process of minimizing gas fees.

Layer-2 Solutions to Lower Transaction Costs

High transaction fees, or gas fees, are a common problem in blockchain networks. Layer-2 (L2) scaling solutions offer a way to significantly reduce these costs.

L2 solutions process transactions off the main blockchain (Layer-1), bundling them together and only submitting the final result to the main chain. This reduces the load on the main network, leading to lower fees. Popular L2 solutions include state channels, rollup technologies (Optimistic and ZK-Rollups), and plasma chains.

State channels allow for numerous transactions between parties to be conducted off-chain, only settling the final balance on the main chain. Rollups, on the other hand, process many transactions in a single batch, verifying them with minimal data sent to L1. They differ in their verification methods: Optimistic rollups rely on fraud proofs, while ZK-rollups utilize zero-knowledge proofs for increased security and efficiency.

Each L2 solution has its own trade-offs in terms of speed, security, and complexity. Choosing the right L2 depends on the specific needs of the application and the priorities of the user. However, they all generally provide a more cost-effective way to interact with blockchain networks compared to on-chain transactions.

Gasless Transactions: Is It Possible?

The concept of truly gasless transactions, where users don’t pay any fees for blockchain interactions, is a complex one. While the term is often used to describe methods that reduce or hide gas fees from the end user, completely eliminating them is currently not feasible on most major blockchains like Ethereum.

Gas fees are fundamentally tied to the operational costs of validating and securing the blockchain. Someone must compensate the network validators (miners or stakers) for their computational work and energy consumption. Therefore, completely eliminating fees would require a radical change to the underlying consensus mechanism, which is not easily achieved.

However, various approaches attempt to mitigate the user’s perception of gas fees. Payment aggregation platforms and sponsored transactions are examples. These services cover the gas costs upfront, often passing the cost to the dapp’s creators or through other indirect means. Although seemingly “gasless” to the user, the fees are still present within the system.

In summary, while various methods make transactions appear gasless, true gasless transactions, in the sense of zero costs to the end user, are currently not a reality on most established blockchains.

Best Wallets for Managing Gas Fees

Effectively managing gas fees requires a wallet that offers transaction customization and fee estimation tools. Several wallets excel in this area.

MetaMask, a popular choice, provides clear gas fee displays and allows users to adjust the gas price to influence transaction speed. This control gives users the ability to balance cost and transaction time.

Ledger Live, while primarily known for its hardware security, also offers gas fee management capabilities within its interface, providing a secure and user-friendly experience.

Trust Wallet offers straightforward gas fee displays and integrates well with various decentralized applications (dApps). Its ease of use makes it accessible to a wider range of crypto users.

Coinbase Wallet provides transparent gas fee information and offers a user-friendly interface for beginners. However, its level of customization may be limited compared to other options.

The best wallet for managing gas fees ultimately depends on individual needs and technical proficiency. Consider factors such as the level of control desired over gas prices, user interface preference, and the specific blockchain(s) being used.

Future of Crypto Gas Fees

The future of crypto gas fees is multifaceted and depends on several evolving technological and market factors. Layer-2 scaling solutions, such as rollups and state channels, are expected to play a crucial role in mitigating high gas fees by processing transactions off-chain before settling them on the main blockchain. This will significantly reduce the load on the network and thus lower costs.

Improved blockchain protocols are also being developed that aim to optimize transaction processing efficiency and reduce congestion. These advancements could lead to inherently lower gas fees. Furthermore, the increasing adoption of more energy-efficient consensus mechanisms, such as proof-of-stake, will contribute to lower overall costs associated with network maintenance.

However, factors such as network congestion during periods of high activity and the increasing demand for decentralized applications (dApps) could still lead to fluctuating gas fees. Therefore, while the future points towards lower and more predictable fees, complete eradication remains unlikely in the near term. The continued development and adoption of innovative solutions are crucial for achieving a more sustainable and cost-effective crypto ecosystem.