Navigating the complex world of cryptocurrency regulations can be daunting, but understanding the legal landscape is crucial for anyone involved in the crypto market. This article provides a comprehensive overview of crypto regulations globally, covering key areas such as taxation, security, and anti-money laundering (AML) compliance. We’ll explore the varying approaches taken by different jurisdictions and offer insights into how these regulations impact cryptocurrency trading, investing, and blockchain technology. Whether you’re a seasoned crypto investor or just beginning to explore this exciting space, understanding crypto regulations is essential for protecting your assets and ensuring compliance.

Why Are Crypto Regulations Important?

Cryptocurrency regulations are crucial for several reasons. Investor protection is paramount; regulations can help prevent fraud, scams, and market manipulation, safeguarding individuals’ investments.

Financial stability is another key concern. Unregulated crypto markets pose systemic risks to the broader financial system. Regulations can mitigate these risks by increasing transparency and oversight.

Combating illicit activities like money laundering and terrorist financing is vital. Cryptocurrencies’ inherent anonymity can be exploited for illegal purposes, and regulations can help prevent this.

Promoting innovation and responsible growth within the crypto industry is also a critical function of regulation. A well-defined regulatory framework can foster trust and confidence, encouraging legitimate businesses to participate and facilitating responsible development.

Finally, fair competition is important. Regulations can ensure a level playing field, preventing unfair advantages and promoting a healthy, competitive market.

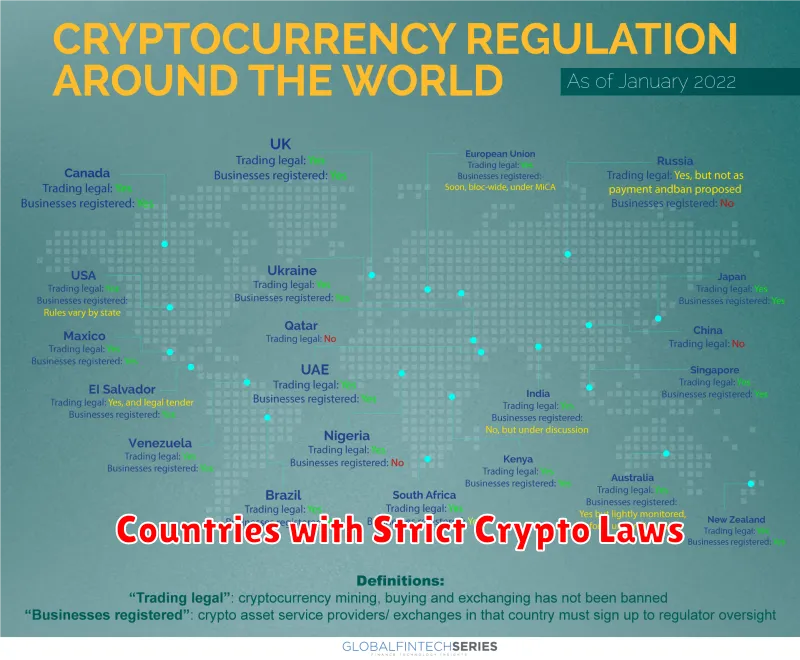

Countries with Strict Crypto Laws

Several countries have implemented strict regulations regarding cryptocurrencies, aiming to control their use and mitigate potential risks. These regulations vary widely in their approach, but often involve limitations or outright bans on certain activities.

China, for instance, has taken a particularly hard line, effectively banning cryptocurrency trading and mining. Similarly, Algeria and Egypt maintain strict prohibitions on cryptocurrency transactions.

Other nations, while not enacting outright bans, have imposed significant restrictions. India, for example, has considered strict regulations, and its current stance involves complex taxation and KYC/AML requirements. Vietnam also imposes tight controls, particularly on the use of cryptocurrencies for payments.

It’s crucial to note that the regulatory landscape is constantly evolving. Countries are continuously updating their laws in response to the dynamic nature of the cryptocurrency market. Therefore, staying informed about specific country-specific regulations is essential for anyone involved in or considering using cryptocurrencies internationally.

How KYC and AML Affect Crypto Users

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are increasingly impacting cryptocurrency users. These regulations require cryptocurrency exchanges and other businesses to verify the identities of their customers and monitor transactions for suspicious activity.

For users, this means providing personal information such as identification documents and proof of address during account registration. Exchanges use this information to comply with KYC/AML regulations and prevent the use of their platforms for illicit activities like money laundering or terrorist financing.

Failure to comply with KYC/AML requirements can result in account suspension or closure. The level of scrutiny varies depending on jurisdiction and the exchange’s risk assessment. While these measures aim to improve security and compliance, they also raise concerns about user privacy.

KYC/AML checks can be perceived as intrusive, especially when dealing with decentralized cryptocurrencies that value anonymity. However, the implementation of these measures plays a vital role in promoting the legitimacy and broader adoption of cryptocurrencies within the financial ecosystem.

The Impact of Crypto Regulations on Market Prices

Cryptocurrency market prices are significantly influenced by regulatory actions. Increased regulatory clarity often leads to price increases as it boosts investor confidence and reduces uncertainty. This is because clearer rules provide a more predictable environment, making cryptocurrencies seem less risky.

Conversely, stringent or ambiguous regulations can trigger price drops. Uncertainty surrounding regulatory outcomes can cause investors to sell, leading to market volatility. Fear of potential bans or heavy restrictions creates a negative sentiment, pushing prices down.

The type of regulation also matters. Regulations focused on consumer protection and market integrity tend to have a positive or neutral impact on prices. However, overly restrictive measures designed to stifle innovation can negatively impact market sentiment and prices.

Geographic variations in regulations also contribute to price fluctuations. If a major market implements stricter rules, it can affect the global price, as traders adjust their positions. Conversely, positive regulatory developments in a significant jurisdiction can buoy global prices.

Finally, the market’s overall maturity influences how it responds to regulation. Established, more liquid markets may react less dramatically to regulatory news compared to newer, less developed markets.

Future of Crypto Regulations

The future of crypto regulations is likely to involve a globalized, yet fragmented approach. Expect to see increased harmonization efforts among nations to create consistent regulatory frameworks, particularly concerning anti-money laundering (AML) and know-your-customer (KYC) compliance. However, significant differences in national priorities and approaches will likely persist.

Increased regulatory scrutiny will continue to target areas like stablecoins, decentralized finance (DeFi), and non-fungible tokens (NFTs). These rapidly evolving sectors currently lack comprehensive regulatory frameworks, leading to a high potential for future rulemaking. We may see the emergence of regulatory sandboxes to allow for innovation while managing risk.

The role of self-regulatory organizations (SROs) within the crypto industry will likely become more prominent. These organizations can help establish industry best practices and work collaboratively with regulators to create more effective rules. Furthermore, the development of clearer definitions for crypto assets and related activities will be crucial for effective regulation.

Ultimately, the future of crypto regulation will depend on the balance struck between fostering innovation and protecting investors. This will be a dynamic and evolving process, influenced by technological advancements and global geopolitical events. Expect continuous adaptation and adjustments as the crypto landscape evolves.